The Bulletin Board is your place to find classes, ongoing programs, job listings, local contests, scholarships, and other opportunities. Events (one time & unique happenings) are also posted on the calendar.

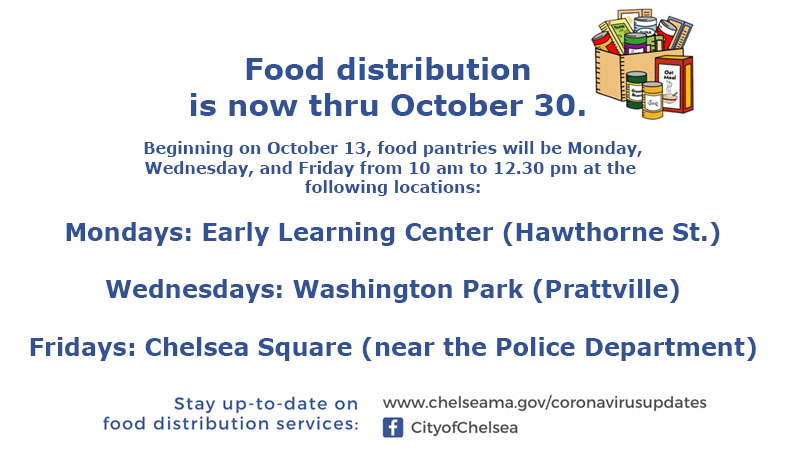

Food Distribution is now thru October 30 / Despensas de comida hasta el 30 de octubre