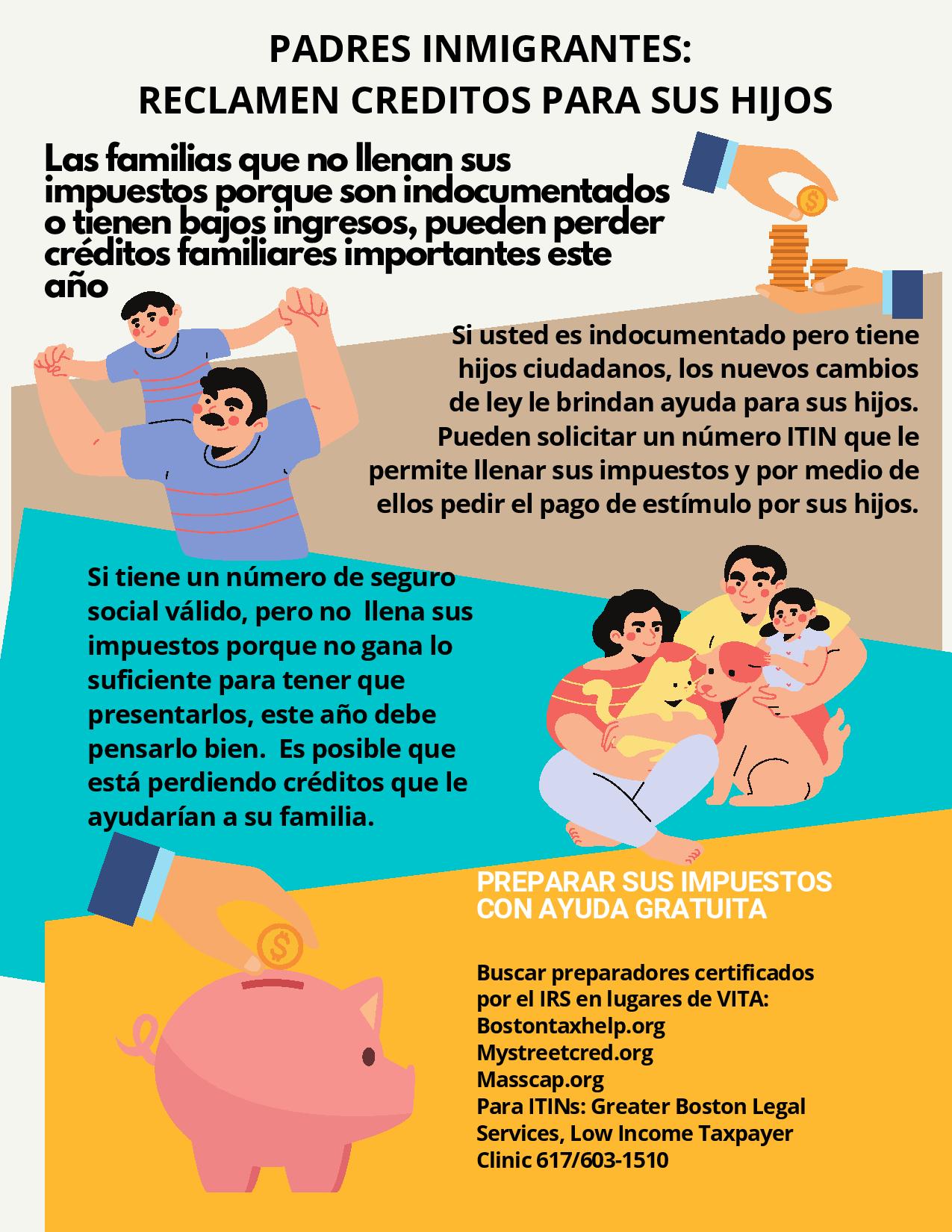

All low-income and no-income parents who have ITINs are being encouraged to file their 2020 tax returns to claim the third stimulus if their kids or other dependents have social security numbers (it’s $1,400 per dependent child or dependent parent, no matter how old) and the new and improved child tax credit, which is for kids under 18– $300 per month for kids 0-6 and $250/month for kids 7-18, starting July 1, 2021.