MIRAS Citizenship Clinics

Virtual Taste of Chelsea 2021, Monday, September 13 at 6-7:30 pm

Zoom-Link to join https://us02web.zoom.us/j/86888310932?pwd=N2Foc1Bab21Lb3VvUU5RaUJOaFk1QT09

Make donation- No Amount Too Small! https://harborcov.org/tasteofchelsea

Please join us for a 2021 Virtual Event!

The Taste of Chelsea will be virtual again this year as we continue taking a cautious approach in light of the health impacts our community has experienced and as we wait to see what the potential is for any additional pandemic concerns in the fall.

The pandemic’s impact was severe on our communities, especially on survivors’ isolation, stress, financial instability and even fewer options for safety. Over the last year, HarborCOV has provided financial assistance for a range of pandemic-related costs like hotels, housing, food, medication and technology for hundreds of families to keep them as safe, healthy and connected as possible. Our local restaurants, which have so generously donated their food, staff time and operational costs to the Taste of Chelsea over the last 18 years, are also still working hard for their own survival and recovery from the pandemic.

Co-hosted by HarborCOV and the Chelsea Chamber of Commerce, the highly visible and popular Taste of Chelsea has traditionally brought together corporate sponsors, local businesses, area food and beverage vendors, volunteers, survivors and more than 500 ticket holders who turn out to show their commitment to the cause along the Chelsea waterfront. We know the 18th annual Taste of Chelsea will continue to capture the event’s traditional spirit of community action.

This year’s virtual Taste of Chelsea will encourage people to order takeout or delivery from a list of participating restaurants and virtually share a meal together while hearing local survivor stories, acknowledging the conscientious sponsors helping support recovery from abuse and learning more about the continuing impact of the pandemic on our communities. We hope you’ll continue your sponsorship and remain part of the community solution to end domestic violence. Your sponsorship has directly benefited local survivors and made a significant difference in their lives while also sending a powerful community-awareness message.

Chelsea Cultural Council supports local artists and small businesses thru cultural initiatives

Introducing Healthy Chelsea new FoodCorps service members

Lindsay Lesniak is a current FoodCorps AmeriCorps Service Member serving with Healthy Chelsea since August 2021. She primarily works with second grade students and younger increasing awareness around gardening and preparing healthy food. Lindsay also works with the Chelsea Public School Meals, advocating for nutritious and culturally relevant foods as increasing seasonal and local produce in schools.

Lindsay holds a bachelor’s degree in Cultural Anthropology and Environmental Studies from Hobart and William Smith Colleges in Geneva, New York.

Rahul is a new FoodCorps Service Member serving Healthy Chelsea for 2021-2022. They will

work with elementary aged students in Chelsea to get them excited about nutritious and fresh

food. They’re from Georgia but consider Boston a second home after going to Boston University

for Computer Science and Mathematics. They also have a background in mutual aid, food

access work, and gardening. In their spare time they love birdwatching, cooking their mom’s

Indian food, and going to concerts.

Silver Line Extension Alternatives Analysis Virtual Public Meeting / Análisis de opciones de la ampliación de la Silver Line Reunión públical pública virtual

Silver Line Extension Alternatives Analysis

Virtual Public Meeting on September 28

Join us for a virtual public meeting on Tuesday, September 28 from 6:00 PM – 7:30 PM for the Silver Line Extension Alternatives Analysis. This study will determine the feasibility, benefits, and cost of extending Silver Line service to Everett and the surrounding communities.

What will I learn at the meeting and how can I contribute?

- At this meeting, we will present an overview of the results of the analysis done so far, and potential Silver Line extension alternatives to further evaluate.

- Staff will be looking for your feedback on draft alternatives connecting Chelsea with Everett, Somerville, Cambridge, and/or downtown Boston.

Following a presentation, the team will be available to take feedback and answer questions. You can view meeting flyers in English, Spanish (Español), Portuguese (Português), and Haitian Creole (Kreyòl Ayisyen) on the event webpage.

The meeting will be held online, via Zoom. To pre-register, please click this link: https://us02web.zoom.us/meeting/register/tZcsfuirqjooGtYGo_XDcc5faj35kNOqmu9a.

After registering, you will receive a confirmation email containing information about joining the meeting. Upon joining you will be prompted to share your first name, last name, and email address.

Meeting attendees will be entered into the project’s email database to receive updates. The meeting will be recorded and posted online for those who cannot attend. You can also email questions anytime to slx@mbta.com.

Online Feedback Form Closes September 21

An online feedback form is available in English, Spanish (Español), and Portuguese (Português). This survey focuses on transit use, desired connections, and rider demographics and will be open until Tuesday, September 21. Feedback gathered through this survey will help inform decisions about extending Silver Line service.

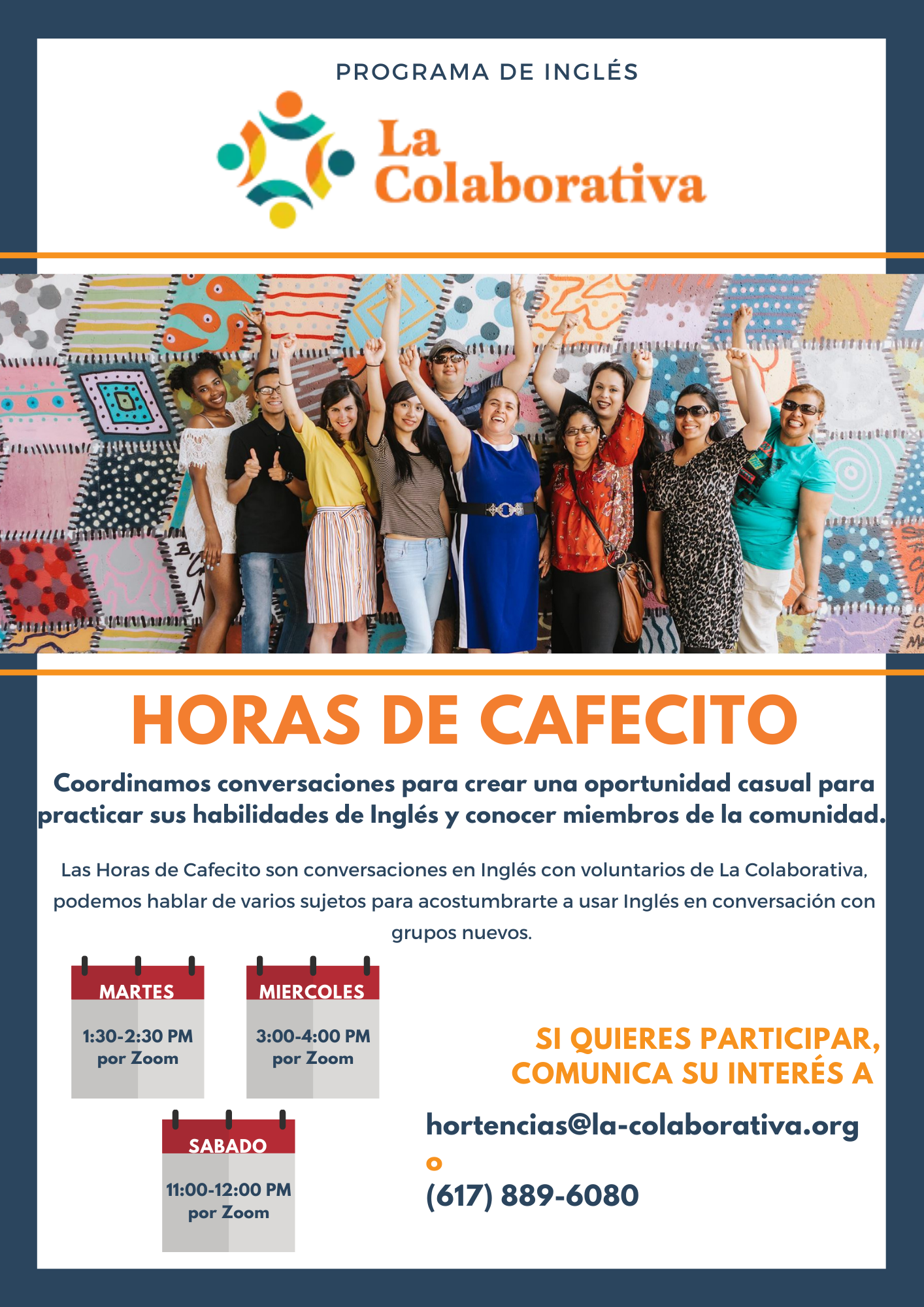

La Colaborativa upcoming events

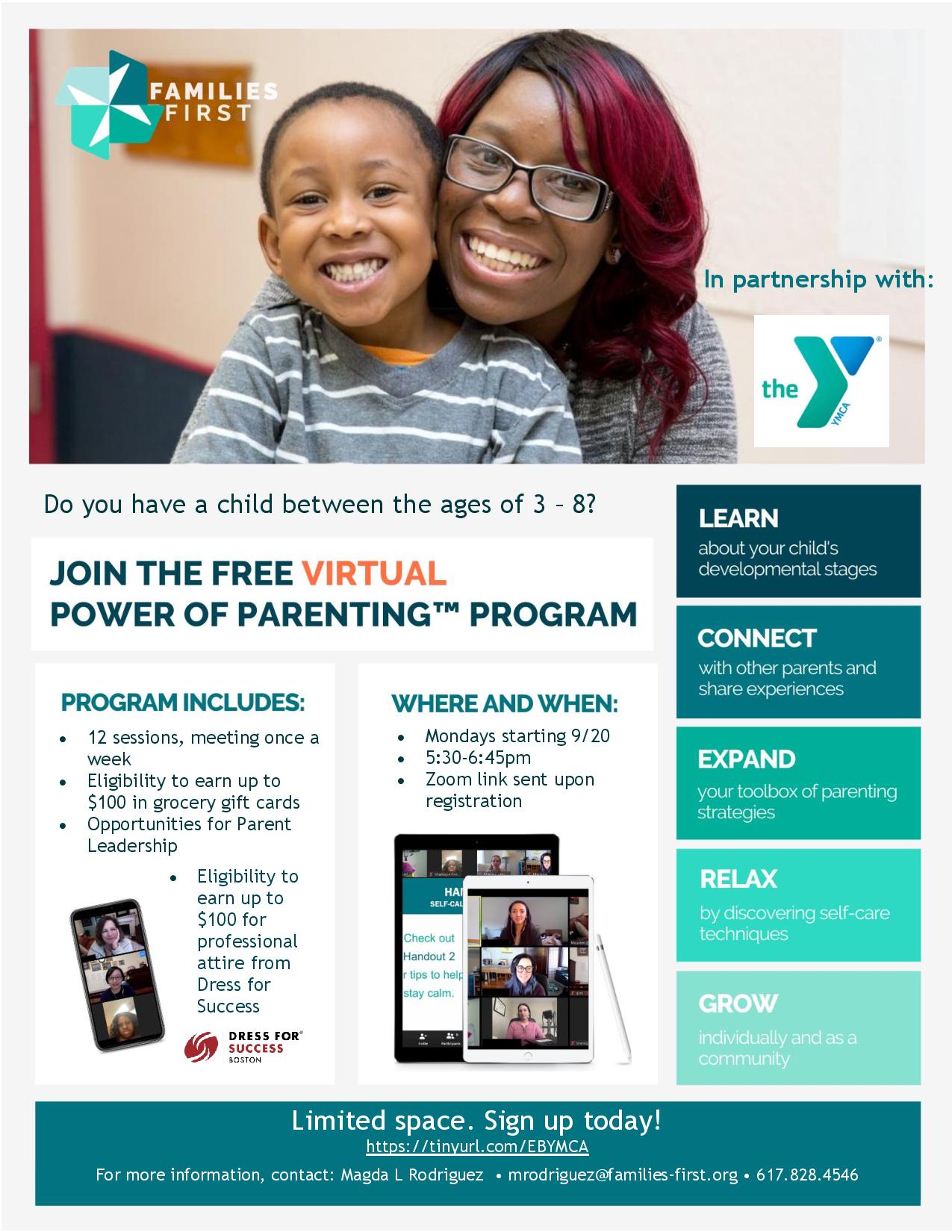

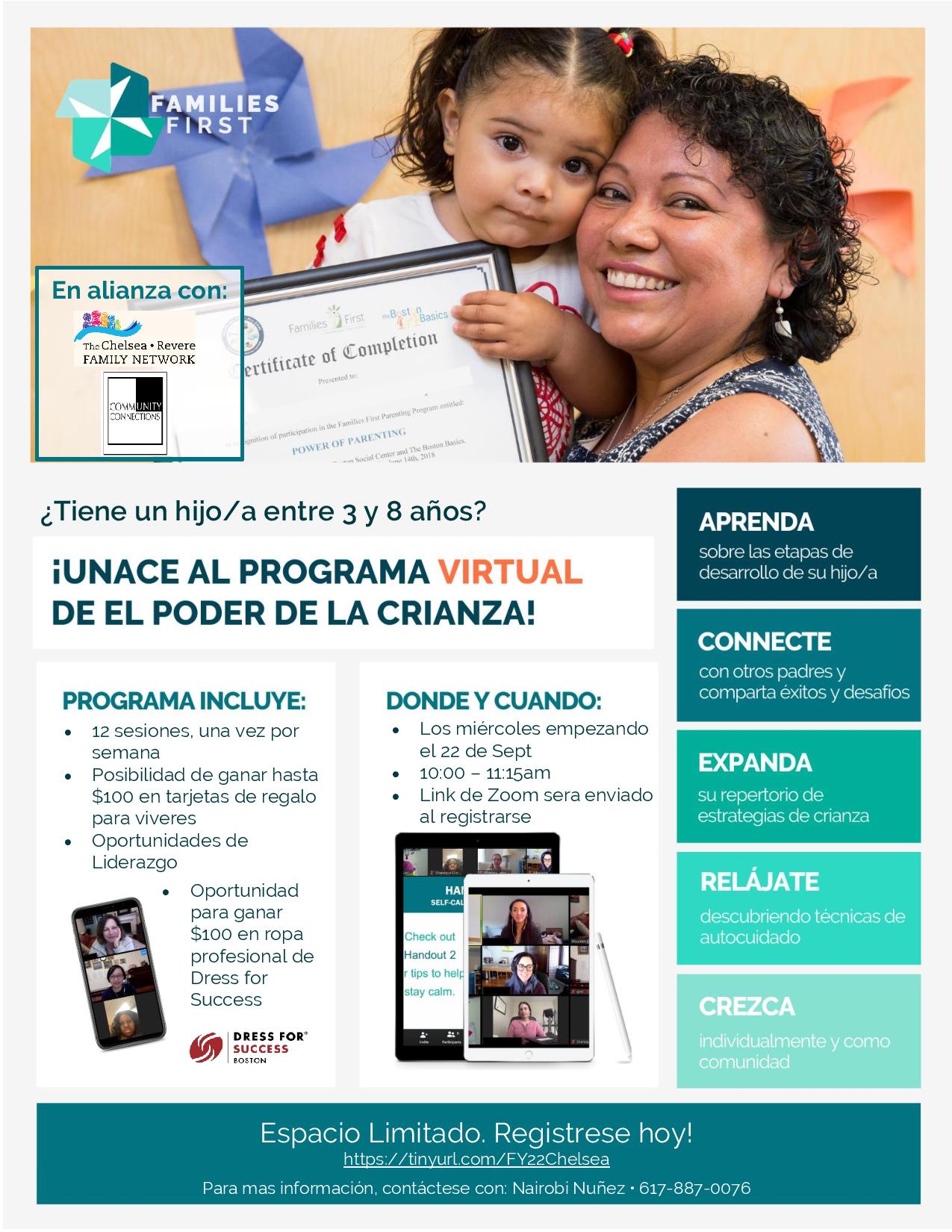

Do you have a child between the ages of 3 – 8? / ¿Tiene un hijo/a entre 0 y 3 años?

Families First is launching 3 Power of Parenting in the Fall

- POP for parents of children 3-8 in English: Mondays, 5:30 – 6:45. Staring on Sept 20th, 2021 – Sponsored by the East Boston YMCA and East Boston Social Center

- POP for Parents of children 0-3 Spanish: Tuesdays, 6:00-7:15. Starting Sept 21, 2021 – Sponsored by East Boston Social Center and Every Child Shines

- POP for parents of children 3-8 Spanish: Wednesdays, 10:00 – 11:15. Starting on Sept 22nd, 2021 – Sponsored by Chelsea Revere Family Network and CCC

End of Summer Movie Night / ¡Fin de verano! Noche de película

COVID-19 Clinic Schedule for the month of September